Are Housing Stipends Taxable? Guide to Corporate Housing Tax Rules

Providing housing for employees or offering a stipend for living expenses can be a valuable benefit for companies with traveling workforces. However, it’s important for employees and employers to understand the tax implications of corporate housing.

Understanding Corporate Housing Tax Basics

Corporate housing refers to temporary or long-term accommodations provided to employees by their employers. This could include apartments, hotels, or even specialized lodging like man camps for oil and gas workers. These housing options can serve as part of an employee’s compensation package or as a necessity for job performance.

For employers, providing housing or stipends involves various tax considerations. Employers must determine whether these benefits are taxable to employees and account for them properly on payroll and tax forms. Failing to understand these rules can lead to compliance issues and unexpected tax liabilities.

Businesses must also consider how tax rules vary depending on the type of housing and the reasons for providing it. Whether housing is taxable often depends on factors such as job requirements, the location of the housing, and IRS guidelines.

Types of Corporate Housing Options

Corporate housing needs differ by industry and employee roles. Common housing options include:

Short-Term Apartments

These are ideal for employees on temporary assignments, offering fully furnished accommodations with amenities such as kitchens and living spaces. Short-term apartments provide comfort and privacy, making them suitable for traveling professionals.

Long-Term Lodging Solutions

For longer assignments, companies often choose corporate extended-stay hotels or furnished apartments. These options offer cost-effective solutions with the convenience of housekeeping and utilities included. Learn more about long-term lodging solutions.

Industry-Specific Housing Requirements

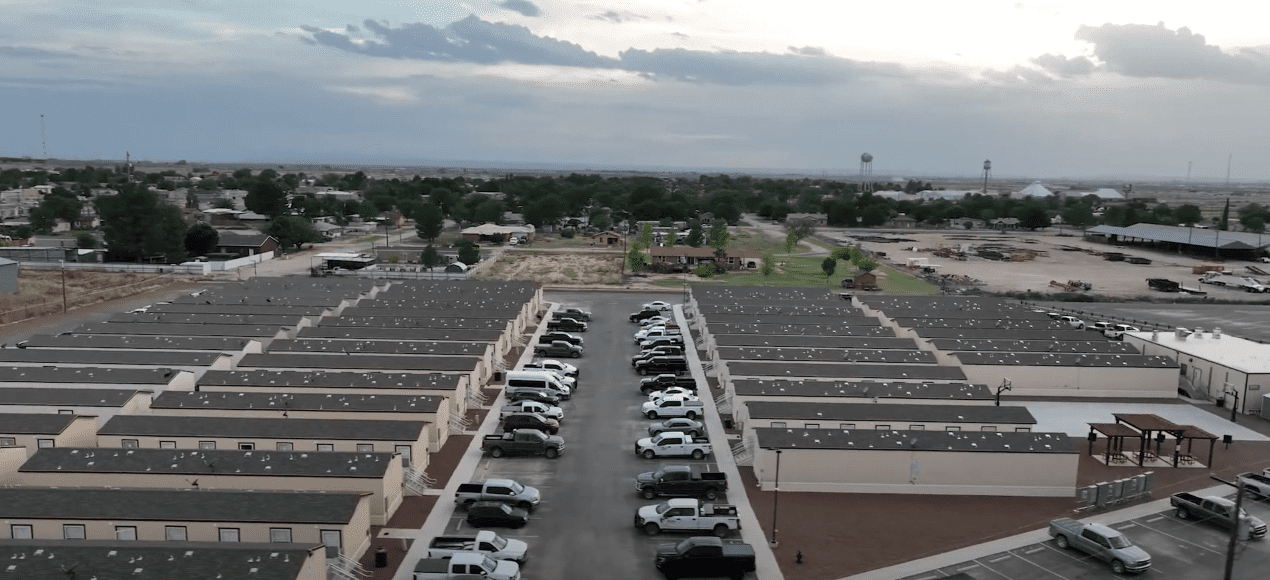

Industries like construction and oil and gas often require unique housing solutions, such as man camps. These facilities provide not only lodging but also dining, recreation, and security, meeting the needs of remote or large-scale operations.

Are Housing Stipends Taxable?

When it comes to housing stipends or allowances, taxability depends on the circumstances. Here are some general guidelines:

- Taxable Housing Benefits: In most cases, housing stipends are considered taxable income and must be reported on employees’ W-2 forms. This includes cash allowances for rent or other housing expenses.

- Non-Taxable Housing: Housing benefits may be non-taxable if they meet certain IRS criteria, such as being provided for the convenience of the employer or being located on business premises.

- IRS Guidelines: Employers must follow IRS rules for housing allowances, which outline the conditions under which these benefits are exempt from taxes. For example, if lodging is a requirement for job performance, it may be excluded from taxable income.

Taxability Exceptions

While housing stipends and corporate lodging are generally taxable, there are exceptions:

Housing on Business Premises

If the housing is located on the employer’s property and is necessary for employees to perform their duties, it may not be taxable. For instance, workers staying in man camps for remote projects may qualify under this exception.

Lodging Required for Job Performance

When employees are required to live in specific accommodations to perform their job effectively, such as traveling healthcare workers, construction crews, or oil rig workers, these benefits might be tax-exempt.

Substantial Business Reasons

Housing provided for substantial business reasons, such as ensuring safety or accommodating large-scale operations, can also qualify for tax exemptions under IRS rules.

Calculating Tax Implications

Employers and employees must understand how to calculate and report the tax implications of housing benefits:

- Fair Market Value (FMV): Determine the FMV of housing provided to employees to accurately calculate taxable income.

- W-2 Reporting: Employers must include the value of taxable housing benefits on employees’ W-2 forms.

- Tax Withholding: Ensure appropriate withholding for federal, state, and local taxes on any taxable benefits.

Tax Reporting Requirements

Proper tax reporting is critical for compliance. Key requirements include:

- Federal Income Tax: Housing benefits classified as taxable income are subject to federal income tax.

- Social Security and Medicare: Employers must account for these taxes when housing benefits are included in wages.

- State-Specific Rules: Tax regulations can vary by state, so it’s important to consult state-specific guidelines for corporate housing.

Industry-Specific Housing Considerations

Certain industries have unique tax rules for housing benefits:

- Construction: Temporary housing for large-scale projects may qualify as non-taxable if it’s essential for job performance.

- Oil & Gas: Man camps and remote lodges often meet the criteria for tax exemptions due to their location and necessity.

- Government Contracts: Housing for employees working on government projects may have additional tax considerations.

- Healthcare: Traveling nurses and medical professionals often receive stipends that must comply with IRS guidelines.

Corporate Housing Tax Rules FAQs

What is it called when your job pays for housing?

This is typically referred to as a housing stipend, housing allowance, or employer-provided housing.

Is a housing stipend always taxable?

No, a housing stipend is not always taxable. A housing allowance that offsets the cost of housing required for job performance or safety meets the IRS criteria for exemption from taxable income.

How do I report housing benefits on tax forms?

Taxable housing benefits must be reported on W-2 forms. Employers are responsible for including the fair market value in taxable wages.

Best Practices for Corporate Housing

To ensure compliance and efficiency in managing corporate housing:

- Maintain Documentation: Keep thorough records of housing arrangements and related expenses.

- Develop Clear Policies: Create housing policies that outline taxability and responsibilities for employees and employers.

- Consult Tax Professionals: Work with tax advisors to navigate complex regulations and avoid compliance issues.

Managing corporate housing doesn’t have to be complicated. By understanding tax rules and leveraging expert resources like Corporate Hospitality Services (CHS), businesses can simplify the process and focus on their core operations.

Contact CHS today for assistance with short- or long-term employee housing.